What is a regretted return for you?

We explain the value of being clear on what is and is not a regretted return

An elegant solution to a wicked problem, or a blunt-force approach to a nuanced issue? In the last year, we have seen notable retailers such as Zara, Boohoo and New Look starting to charge customers for returns. They have all weathered the public relations storm that has ensued and, for now, are holding firm.

Returns are widely reported as costing retailers an estimated £7 billion a year. Some retailers are naturally considering whether customers should share a portion of this cost. But while fees can have their benefits, our analysis of end-to-end returns shows there are several factors to consider and that retailers shouldn’t rush into this decision or take it lightly.

The operational upside might be eroded faster than you think

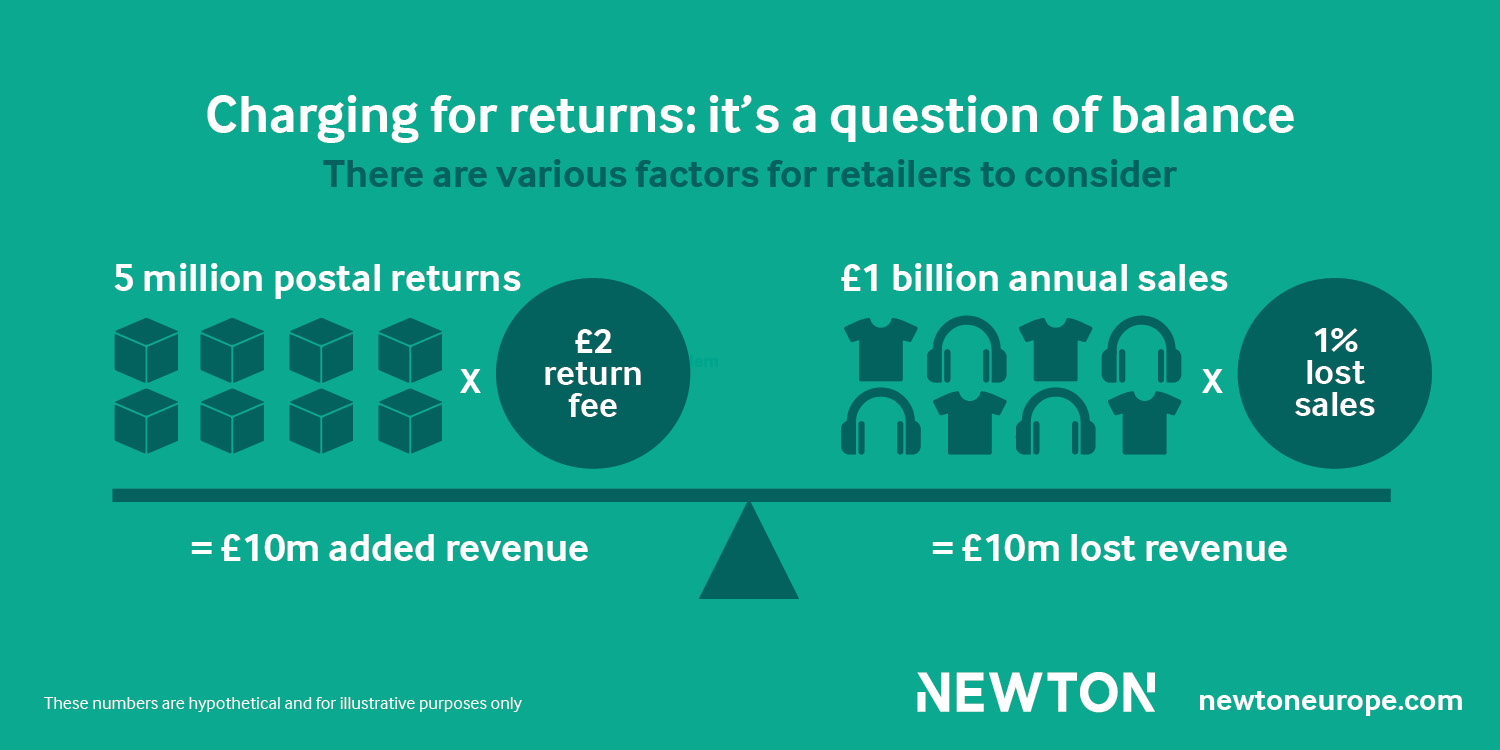

Firstly, most retailers will need to consider the fact that even a small reduction in revenue due to lost sales will outweigh any potential operational benefits.

For example (see image), if we took a typical large retailer that has five million items returned a year through postal routes, and they decided to implement a £2 charge per parcel, they could expect to generate up to £10 million in additional revenue. However, if we assume that this retailer has sales of c. £1 billion, then even a 1% reduction in sales, or importantly, lifetime customer value, would quickly eradicate the business case.

Gaining a comprehensive understanding of how returns volumes and sales propensity are likely to shift prior to implementing a returns fee is important. If this isn’t properly understood, there is a significant risk of taking a short-term view and paying the price in the long-term. By carrying out this pre-mortem analysis for a national retailer, we were able to gain broad business agreement that the strategic risk outweighed the potential upside.

Your customer brand loyalty and proposition matter, a lot

Some retailers are instead exploring changing their returns proposition and business model. For example, we have seen Boohoo offer a subscription model that includes next day delivery, exclusive discounts and importantly, free returns.

This model works if you are confident in your brand loyalty to the extent that you anticipate customers will fork out for yet another subscription. We would expect to see this model only work for a select few; and every additional retailer that attempts it will likely increase the chance that it doesn’t deliver the desired results – as witnessed by CNN+ which misjudged the video streaming market and suffered a costly reputational and cash roll-back.

Other retailers are simply limiting the breadth of free returns. Zara now only offers free returns in-store, for example. There are potential upsides to this, such as cross-selling. However, you also need to consider customer experience and convenience: not disenfranchising your customers who may be loyal but aren’t geographically near to any of your outlets.

The right stock, in the right place becomes tricky when customers are your allocation system

Influencing where returns go – from the channels customers use to where the items end up – is key to realising the inherent value of returns. Introducing a new fee structure could have an impact on this.

At the moment, the ball is often in the customer’s court, and those that are based near your stores are likely to choose that route, especially if it’s the only free option. This means that your highest footfall stores are likely to be inundated with returned stock – putting additional pressure on stores and compounding sub-optimal stock distribution.

If your highest footfall stores are your flagships, you may not want that volume of returned stock there. However, the yin to this yang is that stock may be able to get back on sale faster than if it was processed through your distribution network.

Ultimately, it depends

As with all strategic decisions, the answer to the question of whether to start charging for returns is typically that ‘It depends’. Retailers have access to all the data they need to make an informed decision, but it requires a deep understanding of their customers, proposition and the end-to-end impact on the business. With that at your disposal, you can make sure you know what you’re walking into and aren’t making an already significant challenge worse.

You can find out more about the biggest costs and opportunities in end-to-end returns in our whitepaper, Returns plc: the biggest supplier you didn't know you had. It features new insights and explains five often-obscured areas that retailers should be prioritising to reduce the cost and maximise the value of returns.

In the rest of this series, we will explore some other fundamental questions and how retailers can start to address some of the biggest opportunities in returns, including some of the nudges along the upfront and post-sales customer journey that can help reduce the volume going down the most expensive routes.

We explain the value of being clear on what is and is not a regretted return

Our whitepaper explains the biggest costs and opportunities in retail

Why returns is costing retailers 6% of the RRP of all sales

Newton Europe Ltd

General Enquiries

+44 (0)1865 601 300

Recruitment

+44 (0)2035 980760