Online shopping may be one of the biggest drivers of returns, but many retailers are missing a trick by not making the most of the King of returns channels – the store – to reduce the cost and maximise the value of this stock.

Decisions like where returns go once they enter the business can have a huge impact on profitability, and retailers have a lot more control over this than they realise. In one retailer, our end-to-end analysis of returns revealed that the operational cost of an in-store return was 65% cheaper if it remained in-store for a resale, compared to being sent to a national distribution centre.

There are three key questions for retailers to consider:

- How can I encourage more customers to return in-store?

- How can I reduce the time it takes to process in-store returns?

- How should I decide where to send an in-store return once it’s been processed?

The King of returns channels – encouraging in-store returns

The store has always been and will always be a key part of excellent customer service when it comes to returns, because customers appreciate its immediacy. From a psychological point of view, they enjoy the extra power and control they feel over the outcome of an in-store return. From a financial point of view, they like knowing that their return has been accepted and that they can expect a full refund. And from an experience point of view, entering a store can feel more enjoyable and convenient than many of the alternatives, especially if it’s the most familiar.

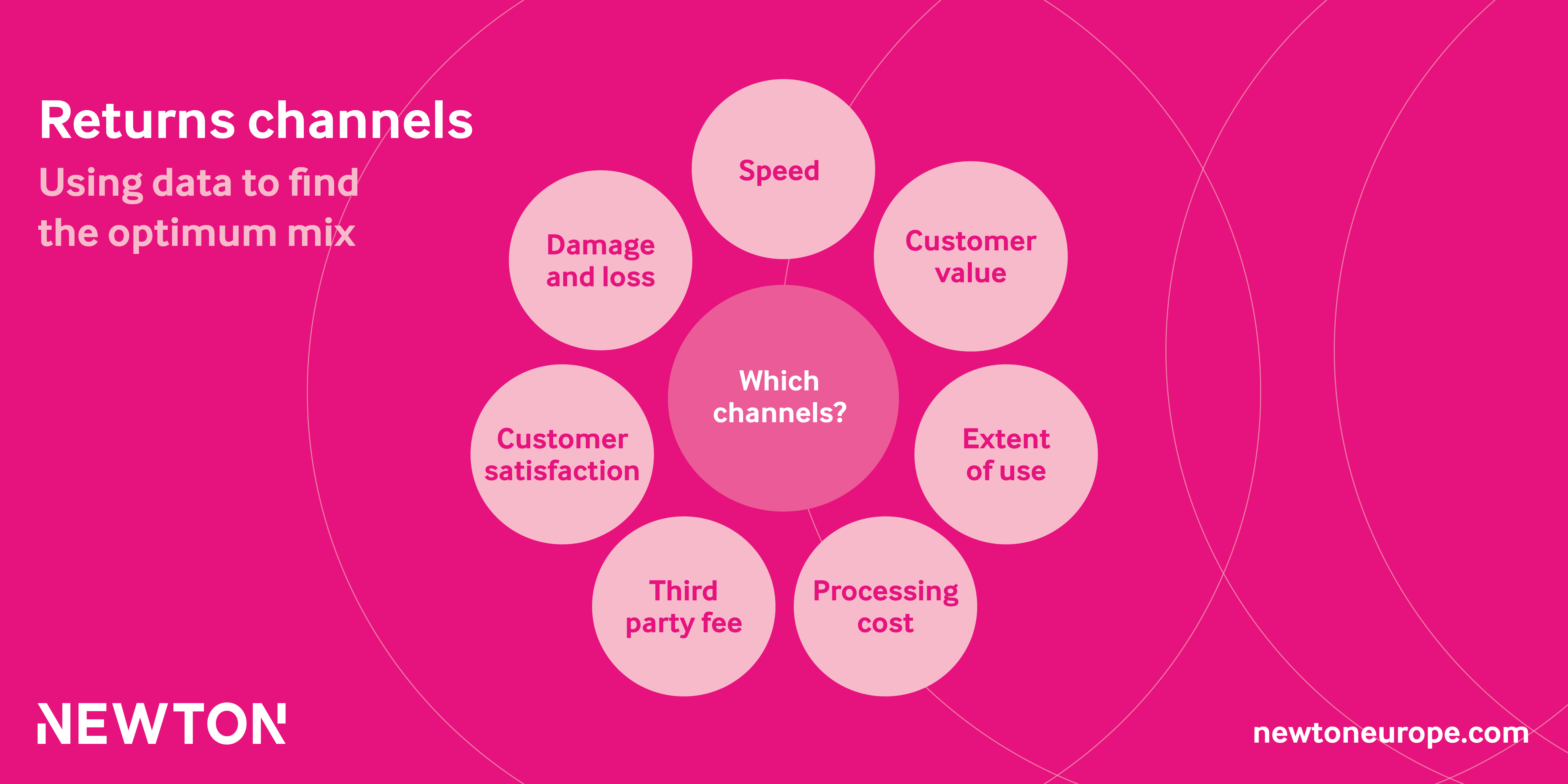

Our research also shows that stores are the most cost-effective channel for retailers to encourage customers to use. While there has been a proliferation of alternative channels and providers in recent years, if you look at the data – extent of use, processing costs, supplier fees, customer satisfaction etc. – those extra channels can quickly start to lose their allure. They can also quickly become overwhelming and confusing for customers to navigate.

And yet, many retailers have continued to add more returns channels without fully understanding the impact on customers or their business. While offering a range of options is important, effective management of returns requires data-driven decisions about the optimal mix and inevitably a cap on numbers. It’s all about understanding what customers truly value and how different channels impact processing times and costs.

Once a retailer has visibility of which channels are the most effective, they can encourage customers down a particular route e.g. by:

- Making it the only free option, as Zara has done with its stores

- Making it the default option on the returns note

- Advertising its benefits and providing clear instructions

Of course, another benefit of in-store returns is their potential to lead to additional purchases.

Reducing dwell time

In high performing retailers, in-store returns would be back on shelves in a number of hours, not days. In reality, it can take retailers more than a week to get returns back in front of the customer, equating to £millions in lost revenue opportunities, not to mention high processing costs.

The root causes of these delays include transferring stock between teams; a mismatch between stock and lists; using multiple IT systems that are slow, inaccurate and don’t talk to each other; and a lack of available data to inform decisions e.g. to prioritise stock replenishment. A longer dwell time also leaves stock more vulnerable to loss and damage, reducing its resale potential.

One of our clients had two separate systems for processing returns at the checkout depending on whether they had been bought in-store or online, with the latter taking more than 2.5 times longer to process a return, and employees actively avoiding using the system.

Some of the biggest opportunities for improvement include:

- Redesigning store processes and creating effective training

- IT changes enabling process efficiency

- Integrated decision-making tools e.g. enabling prioritisation

- Performance tracking and continual improvement

Right product, right time, right place

Stores also play an important role in making sure that returns end up in the right location to maximise the chance of a full price resale. The more information a retailer has available at the point of processing a return, and the more integrated its stores are with the online network, the easier it will be to use returns to meet demand and fill gaps in availability.

There are three critical levers here:

- Making the right decision about what to do with that stock (should it stay in store, go back online or be transferred to a different store?);

- Having the means to move stock between different locations; and

- Completing this process quickly.

To make informed decisions, retailers need to develop data analytics that allow real time decision making and are easy to integrate into their returns process and existing inventory management systems. This will enable them to conduct a data-driven cost-benefit analysis of each return and determine the best course of action. By leveraging proactive and reactive decisions about where and how quickly to move returns, retailers can optimise the residual value of the product.

What is a regretted return for you?

We explain the value of being clear on what is and is not a regretted return

Should retailers start charging for returns?

Or could it make an already significant problem worse?